Can I change the language?

Yes. In the settings section you can choose English, Spanish, French and German as your main language.

Can I change the app’s interface appearance?

Yes. In the settings section you can choose from blue, gold and rose gold skins

Can I change the currency?

Yes. In the settings section you can choose from USD, MXN, EUR, CNY and BTC. In addition, the Plus and Pro versions are capable of having some accounts or assets in one currency and some accounts or assets in another currency.

Can I get alerts about due dates?

Yes. You can configure due dates in credit cards and other liabilities.

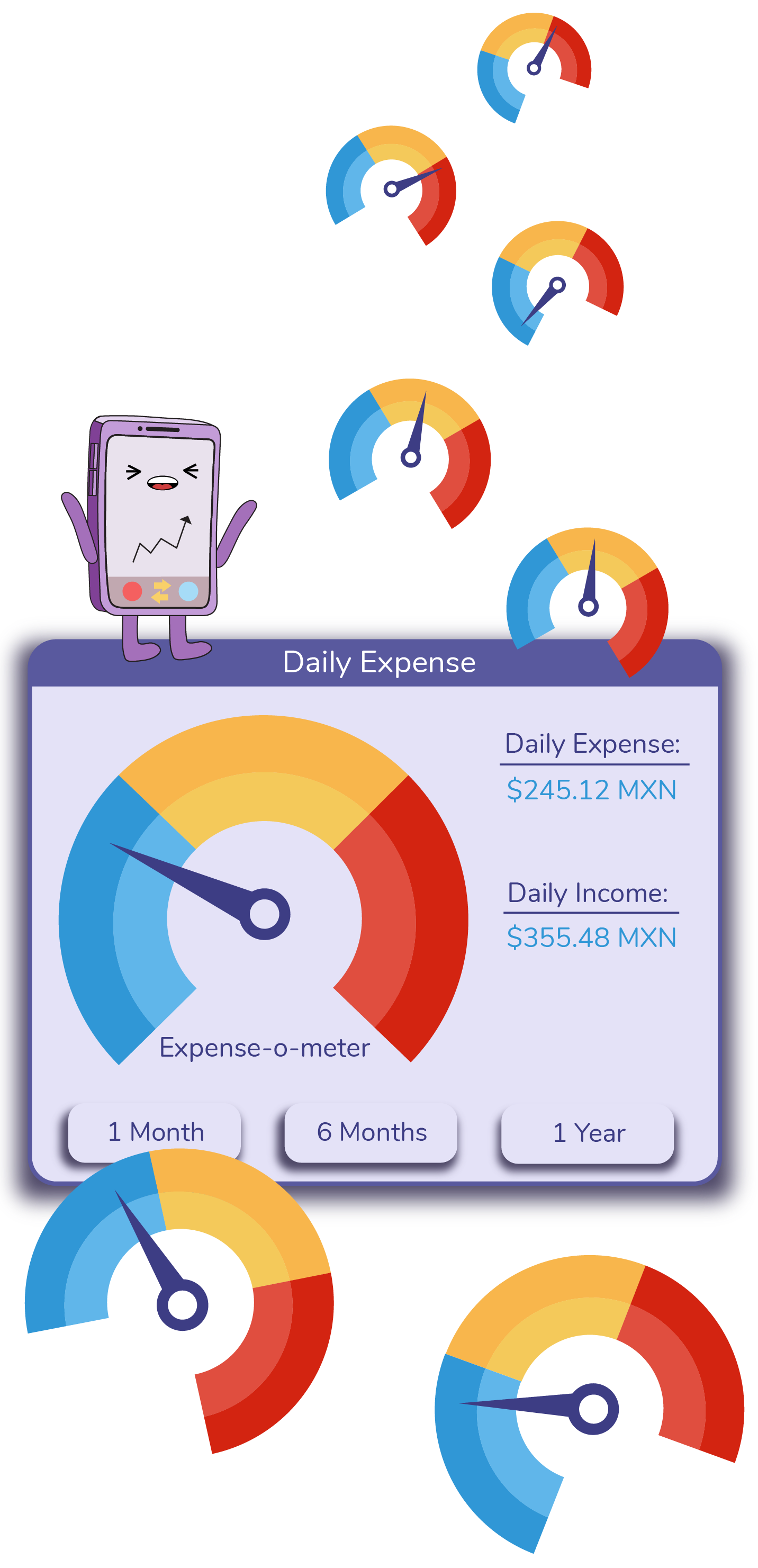

Can I manage budgets?

Yes. The Plus and Pro versions let you register a monthly budget for each category of incomes and expenses, those versions also include a home widget that gives you a graphical representation of the money spent on each category budget.

How many steps does it take to set up my accounts?

It only takes a few easy steps to complete your account. You are only required to set up the accounts that you know you are going to be using. The widgets appearing on your homepage that have not accounts linked to them will either appear empty or with a message that reads “no account has been registered yet”.

How affordable is YMW?

Our payment plans are very affordable in comparison to other applications on the market. You have the option as well of starting with the free version, and then evaluating if the app suits your individual needs.

Can I keep a registry of all my assets other than bank accounts?

Yes. You can register cash and debit, as well as assets such as houses, cars, jewelry or any other object.

Can I keep a registry of all my debts other than credit cards?

Yes. You can register short term debt like credit cards, as well as other liabilities such as short term bank loans.

Can I keep a registry of all my investment accounts?

Yes. You can register the yield or the gain and losses in a period to approximate the behavior of an investment account.

Can I keep a registry of all my financial assets?

Yes, Even with the free version of YMW, you can enter all activities related with deposits and withdrawals, like an income and expense respectively by entering the difference between the current balance of your bank account and the current balance in your App account as a positive or negative value.

How many steps does it take to register an expense?

Very few! From the home screen just tap on the floating button on the lower right corner and select expense, on the new expense screen register amount and account, every other detail is optional! You can optionally choose a different currency, change the date, select a category, write a description, add photos, rate how much you liked it and even make it a recurrent transaction!

Is YMW user friendly?

The app’s interface is laid out with a simple, pleasant design to the eye. All the widgets you will use are found in the Home section of the app, making navigation easy for the user.